New High Dip Strategy

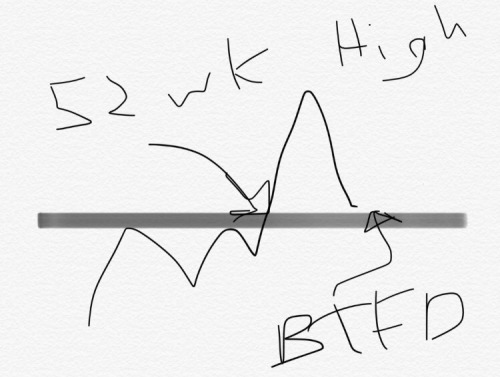

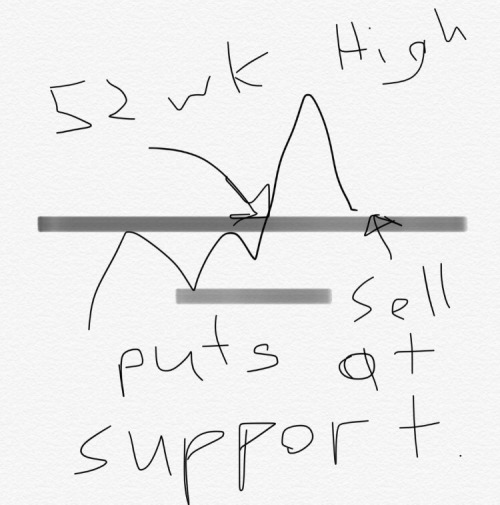

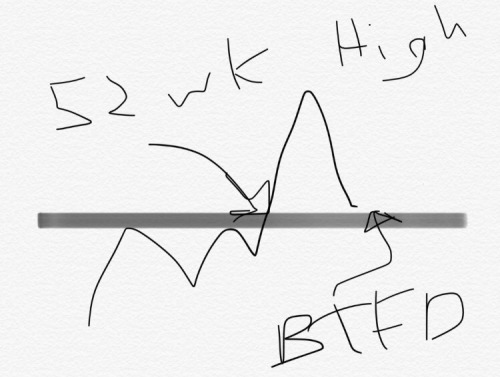

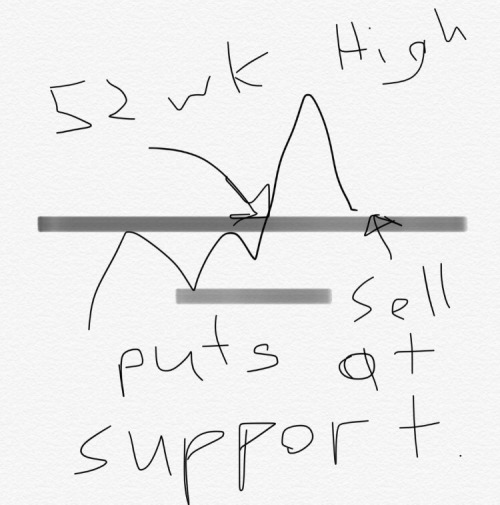

NEW HIGH DIP STRATEGY

Stocks that seems too high tends to go higher! Here is another addition to a BTFD strategy. Buying a stock after it dips from a new 52 week high.

- Get link

- X

- Other Apps

"In bull trends, you buy dips. In bear trends, you sell rallies." - Hager Garcia

Comments

Post a Comment