A Complete Trading System Used by Professionals to Make Millions

If there's one thing that most traders are always looking for, is a set of rules or a system that allows them to trade the markets profitably. In this article I will describe a complete trading system used, in the past, by a very famous trader and the people he taught, and then later on by several hedge funds managed by his disciples.

It can be used "as is", without any modifications, or you can use it as a basis to develop your own system, further enhancing the power of the original rules.

______________

► The Turtle bet

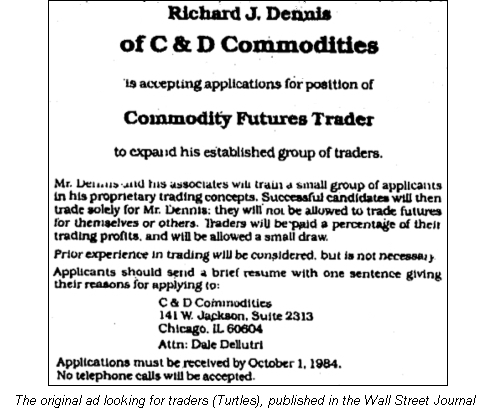

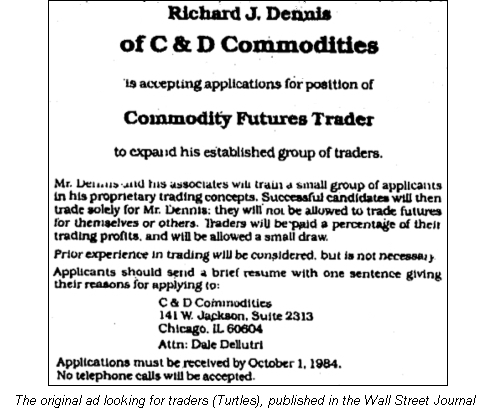

In the early-1980s, one of the greatest and richest traders of the 20th century, Richard Dennis, and his friend Bill Eckhardt, were having an ongoing discussion on the viability of teaching people how to trade. Richard was convinced that it was possible to teach ordinary people to become good traders, while Bill believed that great traders possessed a natural skill, some sort of sixth sense that could not be taught.

In order to settle this discussion they made a bet: they would recruit a few inexperienced people for their trading company, C & D Commodities, teach them the rules of the system they already used, give them capital to trade, and then see if they had become good traders or not.

These people would become known as "The Turtles", because Richard once famously said: "we are going to grow traders like they grow turtles in Singapore".

These people would become known as "The Turtles", because Richard once famously said: "we are going to grow traders like they grow turtles in Singapore".

___________________________________

► The philosophy behind the system

Richard and Bill did not believe that the future direction of the markets could be predicted consistently in the long run, so it was futile to even attempt it. Their whole approach to trading was based on following the market's momentum after a breakout. The idea behind it is that once the market breaches a resistance/support (previous high/low), it is likely to continue in the same direction.

Losing trades are quickly closed once the stop-loss is hit, while winning trades are kept open until the trend reverses, no take profit orders are used.

They were also convinced that a mechanical trading system with rigid rules was the best way to trade, because this way many of the emotions that demonize a discretionary are minimized and even erased. A good mechanical trading system makes it possible to be consistent all the time, and consistency is a key skill to have in order to be successful.

_______________

► Ingredients of the system

Time-frame

Even though the original system used daily bars, you can use any time-frame you wish. However, the shorter the time-frame the lower the profit factor of any system will be, due to trading costs remaining constant and profit potential getting lower. A good technical system should be time-frame neutral, so if you see a system which requires a very specific time-frame to work, be cautious.

System 2 trades would be closed if the price went against the position and exceeded the 20-bar low/high.

System 2 trades would be closed if the price went against the position and exceeded the 20-bar low/high.

Initial stop-loss

These exits can be very far away from the entry price, so the initial stop-loss is placed at 2 x ATR for both systems. Then manually updated once the 10 or 20-bar low/high is lower/higher than the initial stop.

It can be used "as is", without any modifications, or you can use it as a basis to develop your own system, further enhancing the power of the original rules.

______________

► The Turtle bet

In the early-1980s, one of the greatest and richest traders of the 20th century, Richard Dennis, and his friend Bill Eckhardt, were having an ongoing discussion on the viability of teaching people how to trade. Richard was convinced that it was possible to teach ordinary people to become good traders, while Bill believed that great traders possessed a natural skill, some sort of sixth sense that could not be taught.

In order to settle this discussion they made a bet: they would recruit a few inexperienced people for their trading company, C & D Commodities, teach them the rules of the system they already used, give them capital to trade, and then see if they had become good traders or not.

___________________________________

► The philosophy behind the system

Richard and Bill did not believe that the future direction of the markets could be predicted consistently in the long run, so it was futile to even attempt it. Their whole approach to trading was based on following the market's momentum after a breakout. The idea behind it is that once the market breaches a resistance/support (previous high/low), it is likely to continue in the same direction.

Losing trades are quickly closed once the stop-loss is hit, while winning trades are kept open until the trend reverses, no take profit orders are used.

They were also convinced that a mechanical trading system with rigid rules was the best way to trade, because this way many of the emotions that demonize a discretionary are minimized and even erased. A good mechanical trading system makes it possible to be consistent all the time, and consistency is a key skill to have in order to be successful.

_______________

► Ingredients of the system

Time-frame

Even though the original system used daily bars, you can use any time-frame you wish. However, the shorter the time-frame the lower the profit factor of any system will be, due to trading costs remaining constant and profit potential getting lower. A good technical system should be time-frame neutral, so if you see a system which requires a very specific time-frame to work, be cautious.

Recommended pairs

Like the time-frame, a good system should work on all markets, as long as their are liquid, and the costs are low. The Turtles traded currencies, bonds, and commodities with this system. I advise trading as many currency pairs at the same time as possible (scaling back the amounts accordingly), because diversification, when done correctly, is the best way to lower risk while keeping the profit potential intact.

► Finally the rules

This system is formed by two sub-systems. System 1 uses a shorter time-frame based on 20-bar breakouts, while System 2 uses a longer time-frame based on 55-bar breakouts.

Entries

Open a long or short position if the price exceeds the high or the low price respectively of the past 20 periods (Donchian Channel 20).

If the previous 20-bar breakout resulted in a profitable trade this new breakout would be ignored. The previous breakout for this rule is considered the previous breakout shown in the chart, irrespective of its direction (long or short), or whether or not that trade was actually opened, or skipped because of this rule.

Like the time-frame, a good system should work on all markets, as long as their are liquid, and the costs are low. The Turtles traded currencies, bonds, and commodities with this system. I advise trading as many currency pairs at the same time as possible (scaling back the amounts accordingly), because diversification, when done correctly, is the best way to lower risk while keeping the profit potential intact.

► Finally the rules

This system is formed by two sub-systems. System 1 uses a shorter time-frame based on 20-bar breakouts, while System 2 uses a longer time-frame based on 55-bar breakouts.

Entries

Open a long or short position if the price exceeds the high or the low price respectively of the past 20 periods (Donchian Channel 20).

If the previous 20-bar breakout resulted in a profitable trade this new breakout would be ignored. The previous breakout for this rule is considered the previous breakout shown in the chart, irrespective of its direction (long or short), or whether or not that trade was actually opened, or skipped because of this rule.

If a 20-bar breakout is ignored, you are at the risk of missing a big trend, if the price continues to move in the direction of the breakout, so this is where System 2 is useful. If the price exceeds the 55-bar high/low you open a long/short position respectively, in case you didn't open a trade at the 20-bar breakout. All 55-bar breakouts are taken, whether or not the previous one was a winner.

Exits

The system uses manual trailing stops, so a System 1 trade would be closed if the price moved against the position and exceeded the 10-bar low/high.

Exits

The system uses manual trailing stops, so a System 1 trade would be closed if the price moved against the position and exceeded the 10-bar low/high.

Initial stop-loss

These exits can be very far away from the entry price, so the initial stop-loss is placed at 2 x ATR for both systems. Then manually updated once the 10 or 20-bar low/high is lower/higher than the initial stop.

Your article is very informative and useful for those who are interested in bitcoin exchange. Looking for the Vancouver bitcoin exchange then, vancouverbitcoin.com is here to help you.

ReplyDeleteI read your post and got it quite informative. I couldn't find any knowledge on this matter prior to. I would like to thanks for sharing this article here. best forex trading platform online

ReplyDeleteI am attracted by the info which you have provided in the above post.forex trading investments It is genuinely good and beneficial info for us. Continue posting, Thank you.

ReplyDeleteI read your post and this blog is very good. You have provided good knowledge in this blog. This blog really impressed me. Thank you for sharing your knowledge with all of us. online stock trading

ReplyDeleteI am very thankful to you for sharing this best knowledge. This information is helpful for everyone. So please always share this kind of knowledge. Thanks. best forex rebate

ReplyDeleteThe information which you have provided is very good and essential for everyone. Keep sharing this kind of information. Thank you. atlas forex no deposit bonus

ReplyDeleteAfter going through your contents I realize that this is the best of my knowledge as it provides the best information and suggestions. This is very helpful and share worthy. If you are looking for the best new trades career reviews then visit New Trades Career. Keep sharing more.

ReplyDeleteInteresting article. There are several trading platforms and software utilized by professional forex traders to generate profits by speculating on the currency market such as MetaTrader 4 (MT4), Trading Station etc. As a company providing Instant Funding For Forex Traders, I enjoyed reading this. Thanks for sharing.

ReplyDeleteYour blog is really good. This information is really useful for those who have searched for this and you have great knowledge about this. I’m really impressed with your post.best online trading platform in Africa

ReplyDeleteYou have a genuine capacity to compose a substance that is useful for us. You have shared an amazing post about best forex rebateMuch obliged to you for your endeavors in sharing such information with us.

ReplyDeleteHet was fantastisch. Ik denk dat je je verkeer kunt vergroten op basis van je inhoud.

ReplyDeleteAls u uw websiteverkeer, SEO en website laten maken, of app laten maken wilt vergroten, of grafische ontwerp diensten nodig heeft, kunt u contact opnemen met het Nexoz team.

Nexoz services:

Website maken

Application

SEO

Great job for publishing such a nice article. Your article isn’t only useful but it is additionally really informative. Thank you because you have been willing to share information with us.Mutual Funds Investment Online India site.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteYou have done a amazing job with you website How To Earn Passive Income With Cryptocurrency

ReplyDeleteبسیار پست با کیفیتی بود.

ReplyDeleteدر صورت نیاز به خدمات طراحی گرافیک، تبلیغات و یا طراحی و توسعه می توانید به شرکت ریوال ایجسنی اعتماد کنید.

تیم ریوال با سابقه ای درخشان و با در اختیار داشتن کادری مجرب و حرفه ای در عرصه گرافیک و تبلیغات آماده همکاری با شرکت های داخلی و خارجی می باشد.

A very delightful article that you have shared here. Your blog is a valuable and engaging article for us, and also I will share it with my companions who need this info. security bank interest rate Thankful to you for sharing an article like this.

ReplyDeleteسفارش طراحی لوگو حرفه ای در ریوال آنلاین

ReplyDeleteطراحی لوگو و آرم در تیم خلاق ما کاملا حرفه ای و متمایز انجام می شود.

ما بر این باوریم که ایجاد نماد بصری یک برند مستلزم یک دید استراتژیک و علمی است.

A very delightful article that you have shared here. Your blog is a valuable and engaging article for us, and also I will share it with my companions who need this info. Thankful to you for sharing an article like this.INVESTIR EHPAD

ReplyDeleteطراحی لوگو تمام اطلاعات لازم در ریوال آنلای را در یک نگاه به مشتری می دهد.

ReplyDeleteتمام برندهای معروف را از گذشته تا امروز به یاد بیاورید! طراحی لوگوی این برندها یکی از خلاقانه ترین ابزارها برای ارائه محصولات و خدمات آنها بوده است.

در واقع، یک طراحی موفق لوگو به شما کمک می کند از لوگوی خود به عنوان سلاحی برای هدف قرار دادن ذهن مشتریان در یک نگاه و نشان دادن هویت خود به آنها استفاده کنید.

I am grateful that I was able to learn something useful from this article. After reading it, I believe you possess excellent expertise. Thank you for sharing about ZuluTrade best traders. Keep up the good work.

ReplyDeleteتیم طراحی لوگو لوگووین طرحی را ایجاد می کند که به ایجاد برند شما کمک می کند.

ReplyDeleteتیم لوگووین مجهز به حرفهایترین ابزارها برای توسعه کمپینهای شما و انتشار در چندین پلتفرم برای تعامل و جذب بهتر مخاطبان است.

این طراحان حرفه ای تجربه بی نظیری در طراحی های لوگو دارند و از آخرین به روز رسانی ها، ابزارها و فناوری ها برای کشف ایده های خلاقانه برای خلق جلوه های هنری و بصری چشم نواز استفاده می کنند تا مخاطبان هدف خود را در هر سطحی به دست آورند.

لوگووین از یک رویکرد گرافیکی و کاربر محور با دیدگاهی آیندهنگر از نتایج فروشمحور استفاده میکند.

منبع : Winon.ir

I appreciate your efforts which you have put into this article. Genuinely it is a useful article to increase our knowledge. Thanks for share an article like this.DAY Trading System

ReplyDeleteA very delightful article that you have shared here.Learn Stock Market Trading Online Your blog is a valuable and engaging article for us, and also I will share it with my companions who need this info. Thankful to you for sharing an article like this.

ReplyDeleteExcellent post. I really enjoy reading and also appreciate your work. This concept is a good way to enhance knowledge. Keep sharing this kind of articles, Thank you.stock market advisor

ReplyDeleteYou have worked nicely with your insights that makes our work easy. The information you have provided is really factual and significant for us. Keep sharing these types of article. Invest Your Money in India

ReplyDeleteThis article contains a lot of huge information. I'm surprised by the idea of the information and moreover it is a productive article for us, Gratitude for share it.Best stock market books

ReplyDeleteشرکت لوگووین یک تیم حرفه ای در حوزه های مختلف طراحی سایت و سئو و طراحی لوگو و ... می باشد.

ReplyDeleteهمکاری با شرکت ها سازمان ها و افراد مختلف از کشورهای بزرگ دنیا این آژانس را تبدیل به یک صادر کننده ایده,خلاقیت و هنر به خارج از مرزهای کشور کرده است.

https://logowiin.ir/

Thanks for your post. It's very helpful post for us. I would like to thanks for sharing this article here. Best broker for forex trading

ReplyDeleteآژانس طراحی و تبلیغات جاسینا می تواند به انواع مختلف مشاغل، از جمله مشاغل کوچک و متوسط تا شرکت های بزرگ، خدمات ارائه دهد. این تیم حرفه ای همچنین می توانند به مشاغل در صنایع مختلف، از جمله خرده فروشی، خدمات مالی، فناوری و غیره، خدمات ارائه دهند.

ReplyDeleteبرخی از خدمات این آژانس عبارتند از:

* طراحی گرافیکی

* طراحی وب سایت

* بازاریابی محتوا

* تبلیغات آنلاین

* تبلیغات آفلاین

* روابط عمومی

منبع : www.jasina.ir

سیستم معاملاتی ارائه شده در این صفحه واقعاً جالب و کاربردی است. برای واردات و صادرات کالاهای تجاری خود از ایران به سایر کشورها و بالعکس، ما در شرکت نمایندگی کشتیرانی دروازه طلایی دریای نور خدمات حمل و نقل دریایی و کانتینری ارائه می کنیم.

ReplyDelete