Patterns in Stock Prices

What Patterns Do I Look For?

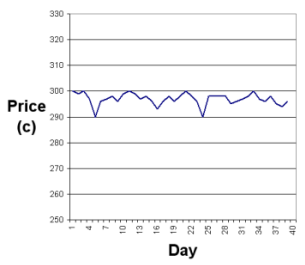

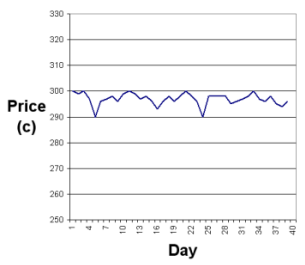

I like to trade stocks whose price was moving in an obvious trend. I'm not interested in stocks whose price showed small price changes with no strong trend - such as the one shown on the left.

The Pivotal Point

Always have the patience to wait for the market to arrive at what I call a Pivotal Point before starting to trade.

Consider the chart on the left. The price had been trending downwards before rallying from a low of 40c. The rally could not be maintained, however, and the stock has retreated to 40c again. 40c has become what I called a pivotal point. Any significant move either upwards or downwards from the pivotal point would be traded.

I like to trade stocks whose price was moving in an obvious trend. I'm not interested in stocks whose price showed small price changes with no strong trend - such as the one shown on the left.

Always have the patience to wait for the market to arrive at what I call a Pivotal Point before starting to trade.

Consider the chart on the left. The price had been trending downwards before rallying from a low of 40c. The rally could not be maintained, however, and the stock has retreated to 40c again. 40c has become what I called a pivotal point. Any significant move either upwards or downwards from the pivotal point would be traded.

If the stock were to break below, say, 37c, I would sell short. If it were to break above, say, 43c, I would buy. I would observe the price action carefully after the buy because 49c - the high of the earlier rally - is another pivotal point. If the price failed to rally above 49c - again by 3c, say - I would exit from the trade.

The Normal Reaction

Once a stock had broken out of a trading range - such as the stock on the left, which has broken downwards - I would begin trading. In this case the breakout is downwards and so I would sell the stock short.

I would look for signs that the new trend was behaving normally and that it would be safe to stick with the trade.

The following signs I would look for:

- At the beginning of the move there should be an unusually large volume of shares traded.

- Prices should move generally in one direction (upwards or downwards) for a few days.

- A normal reaction should be observed - volume will decrease compared with the volumes observed during the initial trend, and the price may move against the trend somewhat.

- Within a day or two of the normal reaction, volume should increase again and the price trend should be resumed.

Provided this pattern is repeated, it is safe to stick with a trade. If there should be a deviation from the pattern, it is a warning sign. If the pattern fails and the price moves against the trend by more than a little, it is a sign to exit your trade and preserve your profit.